If you think Bitcoin is still just a fringe economic event, consider that Coinbase has more users than Charles Schwab has brokerage accounts. Adoption is growing.

In a sign of growing mainstream acceptance, digital currency exchange Coinbase now boasts more accounts than brokerage firm Charles Schwab. According to its website, Coinbase has 13 mln users while the number of Schwab brokerage accounts stood at 10.6 mln as of the end of 2016.

These numbers don’t paint a complete picture, since the amount of assets controlled by Schwab certainly vastly exceeds those of Coinbase users. Nevertheless, the actual number of users indicates a massive volume of adoption, as the public begins to dabble in cryptocurrencies. Coinbase user numbers have grown by 167% this year.

Widespread awareness

Coinbase openly publishes the number of active accounts on their site, and traders have been keeping a close eye on those numbers throughout the digital currency boom this year. Such large numbers of individuals creating accounts on cryptocurrency exchanges should put an end to the thought that Bitcoin is just a fringe economic event.

Regardless of bullish or bearish expectations, the reality is that Bitcoin is gaining traction amongst members of the general public. This is further demonstrated by the offering of futures by the Chicago Mercantile Exchange (CME), the proliferation of hedge funds and the embrace of Bitcoin in cash-strapped countries.

from: https://cointelegraph.com/news/bitcoin-going-mainstream-coinbase-has-more-users-than-charles-schwab

Bitcoin Crushes $9,000 on Growing Signs of Mainstream Adoption, Wall Street Interest

Bitcoin has officially hit the $9,000 mark today, as the massive user adoption from hedge funds, soon-to-be-released futures markets and further increases in the number of users.

Ironically, many on the /r/BitcoinMarkets subreddit expected the price to drop over the Thanksgiving weekend, in part due to US banks being closed. However, over the past week the price had shown strength, consolidating in the low $8,000s. Twice the price briefly dipped into the $7,800 range, but those dips were rapidly bought.

Apparently people didn’t merely take advantage of Black Friday to buy TVs and electronics, but also stocked up on Bitcoin. The price began trending up yesterday as the market began adding volume, and today broke the next major psychological hurdle of $9,000.

More to come?

Thought many mainstream finance pundits regard Bitcoin as a bubble, the market has not shown any signs of a so-called “blow off top,” meaning a sudden and major reversal is unlikely at the moment. Bubble cycles often end with a massive spike in prices that’s almost immediately followed by an even larger sell-off.

The next major hurdle, and arguably the largest psychological barrier of all, is $10,000. However, that may not be as hard to breach as one might think, considering that the combined price of Bitcoin and Bitcoin Cash already well exceeds $10,000. That is to say, anybody who owned Bitcoin prior to August 1 and didn’t sell their Bitcoin Cash is already enjoying prices in excess of the next major target.

Analysts such as the normally bearish Tom Lee, founder of Fundstrat, are turning bullish. Lee recently indicated that his near term price projection is $14,000. He explains away the brief dip that followed the cancellation of SegWit2x as a shaking out of weak hands. At press time, Bitcoin’s price on the GDAX exchange was $9,085.

[08 DEC 2017]

Coinbase adds 100,000 new customers each day since November

Coinbase employees lining up for free food in the gaming room of the company’s office in San Francisco.

Coinbase: The Heart of the Bitcoin Frenzy

SAN FRANCISCO — The booming stock market of the 1920s had the New York Stock Exchange. The tech bubble of the 1990s had Nasdaq and E-Trade. And the virtual currency market of the last year has had Coinbase.

Coinbase has been at the center of the speculative frenzy driving up the value of Bitcoin — which topped $13,000 on Wednesday — and similar currencies. While there are many Bitcoin exchanges around the world, Coinbase has been the dominant place that ordinary Americans go to buy and sell virtual currency. No company had made it simpler to sign up, link a bank account or debit card, and begin buying Bitcoin.

The number of people with Coinbase accounts has gone from 5.5 million in January to 13.3 million at the end of November, according to data from the Altana Digital Currency Fund. In late November, Coinbase was sometimes getting 100,000 new customers a day — leaving the company with more customers than Charles Schwab and E-Trade.

The company faces challenges that are a reminder of the early days of now-mainstream online brokerages, which suffered through untimely outages and harsh criticism from traditional finance companies and government regulators. And Coinbase’s missteps make it clear that the virtual currency industry is still young, with little of the battle testing that other financial markets have faced.

An employee working in a nook inside Coinbase’s offices. — Credit: Jason Henry for The New York Times

Coinbase’s offices in downtown San Francisco show a start-up straining to keep up with growth. The company offers all the usual perks: free lunch and dinner, a sizable cafeteria and a room with yoga mats and board games.

Recently, every last inch of space has been pressed into action. The day after Bitcoin hit $10,000 last week, a training session for Coinbase managers was moved to the game room because the engineering team needed to set up an emergency war room in the regular conference room.

The engineering team was trying to get Coinbase back up after the company’s site was knocked offline, overwhelmed by a wave of incoming traffic. The number of visitors was double what it had been during the previous peak — two days earlier — and eight times what it had been in June, the peak until recently.

All of the big Bitcoin exchanges went down for at least part of the day, and Coinbase got back online faster than most. Still, any sort of downtime like that would be unacceptable in more traditional exchanges where stocks and commodities are traded.

“There are some well-known places this year when we weren’t able to keep up with the volume,” said Jeremy Henrickson, the chief product officer at Coinbase. “We are not where we need to be yet.”

Coinbase employees tossed around a “talk box” during a question-and-answer session with company executives.

Credit: Jason Henry for The New York Times

Most Friday afternoons, Brian Armstrong, the chief executive of Coinbase, holds a session in the cafeteria where employees can ask him anything. On the Friday of the record-hitting week, Mr. Armstrong discussed how the company was planning to grow and introduced Asiff Hirji, the new president and chief operating officer who will help him oversee it all.

The addition of Mr. Hirji, who had the same role at TD Ameritrade, was an implicit recognition that this new industry needs more seasoned hands to help young executives like Mr. Armstrong, who is 34. Mr. Hirji will manage Coinbase’s trading operations while Mr. Armstrong focuses on new projects.

Mr. Armstrong has been running Coinbase since he co-founded it in 2012. Soft-spoken and reserved, he is an unusual figure in an industry filled with loud ideologues. He has done few public appearances during Bitcoin’s recent bull market, and he recognizes the current frenzy has come with downsides.

“It’s probably a little bit too focused on the price or people trying to make money,” Mr. Armstrong said last week. “The thing I’m passionate about with digital currency is the world having an open financial system.”

There is some irony to the success that Mr. Armstrong has experienced as a result of Bitcoin’s rising price. In 2015, he helped lead a push to get the Bitcoin network to expand so it could handle more transactions. That effort failed, and Mr. Armstrong said in a recent interview that Bitcoin “did break my heart a little bit.” He said he now holds more of his wealth in a Bitcoin competitor, Ether, which Coinbase also offers to customers.

A monitor in the Coinbase office displaying the value of several virtual currencies.

Most of the screens in the Coinbase offices show the performance of the company’s servers and customer metrics — like the number of customers downloading its iPhone app. For a time last week, Coinbase was among the 10 most downloaded iPhone apps, ahead of Uber and Twitter.

There are a few screens, including one in the cafeteria, that show the price of Bitcoin, Litecoin and Ether, the three virtual currencies that Coinbase buys, sells and holds for customers. Litecoin was created by a former Coinbase employee and is often described as silver to Bitcoin’s gold. The newer Ether, which lives on the Ethereum network, is the second most valuable virtual currency after Bitcoin.

Coinbase set itself apart from other early Bitcoin companies when it was one of the first to get a new, special license for virtual currency companies in New York, called the BitLicense.

In the last year, though, Coinbase’s most notable interaction with the government came after the Internal Revenue Service asked the company to hand over all of its customer records. Bitcoin holders are supposed to pay taxes if they collect gains from selling coins, but the I.R.S. has said that only a few hundred people have done so each year.

Coinbase fought the broad request from the I.R.S. and last week, while the price was skyrocketing, announced an agreement to hand over only the records of customers who made transactions involving more than $20,000 of virtual currencies — around 3 percent of the company’s customers.

Adam White, the general manager of a Coinbase exchange for large investors.

In addition to the brokerage service for small investors, Coinbase also runs an exchange, called GDAX, tailored to larger investors.

GDAX is overseen by Adam White, a former Air Force officer and a graduate of Harvard Business School. The day Bitcoin hit $10,000, he was in New York speaking with big financial institutions that are looking into Bitcoin. Some companies are getting ready to begin trading Bitcoin futures contracts in December, when that activity becomes available on the Chicago Mercantile Exchange.

A year ago, his Wall Street outreach was difficult, but “it’s all inbound now,” Mr. White said.

Not surprisingly, Coinbase is on a building spree. It recently leased office space in New York that will handle the Wall Street business and a new service that holds virtual currencies for large customers. In San Francisco, the company is adding two new floors in the building where it now has one.

Still, the main concern among virtual currency investors is that Coinbase has not expanded fast enough. In May, the company was criticized by a customer who could not reach anyone at the company after his account was hacked.

Coinbase is trying to be more responsive. At the beginning of the year, the company had 24 employees providing customer support. It now has around 180, with most of them outsourced from a call center in Texas and an email response team in the Philippines. The cafeteria is often turned into a “Crypto Club” where new employees are taught the ins and outs of virtual currency.

Daniel Romero, the general manager of Coinbase, said he wanted to have 400 customer support employees by the first quarter of next year to provide phone support around the clock. But in the meantime, there is a 10-day backlog of service requests.

“When your customer support issues are that publicly bad, and you have your site go down when people want to be trading,” it’s a very humbling experience, Mr. Romero said.

from: https://www.nytimes.com/2017/12/06/technology/coinbase-bitcoin.html

[08 DEC 2017]

Demand Wrecks Bitcoin Infrastructure

It is 1994 all over again ![]() — TJACK

— TJACK

The rise in Bitcoin price has been paralleled by a huge increase in demand which has effectively wrecked the Bitcoin trading infrastructure, according to a number of sources. Exchanges like Coinbase have experienced huge slowing, LocalBitcoins has stopped accepting new customer applications, and unconfirmed transactions have skyrocketed.

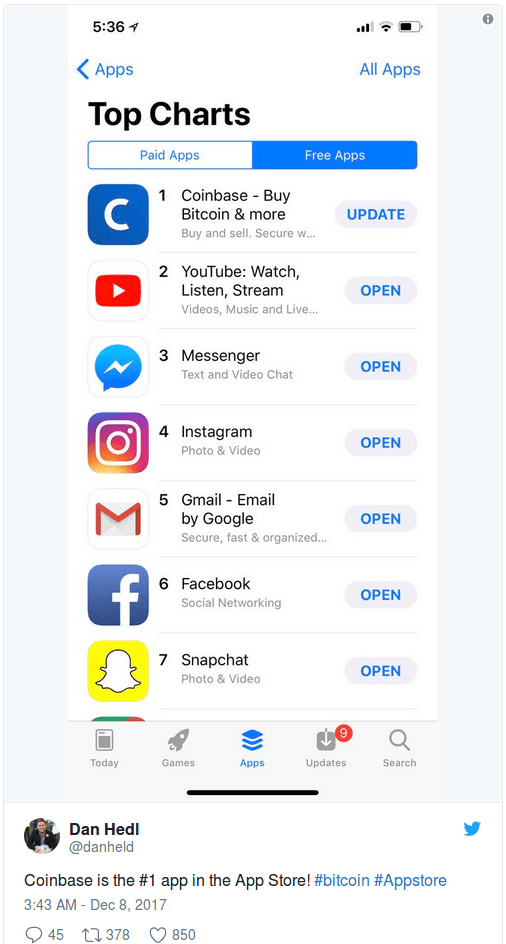

The price point hit peaks over $18,000, though has since scaled back. Nevertheless, demand continued to increase among exchanges. Coinbase was recently tagged as the #1 most popular app on the iTunes store, per Twitter:

Exchanges down

Nevertheless, while demand was increasing, the power to control the exchange and provide service was slowing. In fact, so many users met with difficulty that it was covered on mainstream media. And the Coinbase Twitter account was awash with tweets of error pages.

But Coinbase wasn’t the only victim. Others fell apart as well. LocalBitcoins even went so far as to stop accepting new clients completely. In a post on the site’s Twitter feed, they made it clear that they were unable to service current clients and could no longer accept new ones.

And it wasn’t just these two sites. All across the Bitcoin landscape, transactions were slow and users were frustrated as the network experienced some of the highest trading volumes of all time. In fact, nearly 300,000 transactions were pending at one point. The Litecoin Foundation was quick to point this out:

Growing up

As adoption increases, the need for scaling to meet the massive growth in demand will only increase. The massive surge in the marketplace certainly means that response times are slow but should provide encouragement to those who are holding existing stock of Bitcoin that the bull will continue to run. Dominik Schiener, co-founder at IOTA said:

“The fact that exchanges are still struggling with scalability issues after years of development and investments into their infrastructure is a clear indication that the demand for cryptocurrencies is increasing exponentially, unexpectedly so for everyone. It is quite unfortunate that the first experience when entering the realm of cryptocurrencies is filled with frustration of congested networks and exchanges with continuous downtime, but this community still has a whole lot of growing up to do before we’re ready for mainstream adoption.”

from: https://cointelegraph.com/news/demand-wrecks-bitcoin-infrastructure

You must be logged in to post a comment.